Understanding Machine Learning and Reinforcement Learning

In modern financial markets, machine learning has become an essential tool for traders seeking efficiency and profitability. One of the most powerful techniques in this space is reinforcement learning (RL)—a form of machine learning that enables ARC Trader to develop and refine trading strategies by learning from real-world market data. Unlike traditional algorithmic trading, ARC Trader doesn’t just follow predefined rules—it evolves by continuously training itself to recognize profitable patterns.

Understanding Reinforcement Learning in Trading

Reinforcement learning is based on an agent-environment interaction model, where an agent (ARC Trader) takes actions (buy, sell, or hold), receives rewards (profit or loss), and improves its decision-making process over time.

At the heart of reinforcement learning is Q-learning, an advanced method that assigns reward values to different actions based on their success. This approach allows ARC Trader to maximize long-term profitability by constantly optimizing its trading strategy.

How Q-Learning Works in ARC Trader

- Market Data Collection: ARC Trader downloads and analyzes real-time market data from sources like Robinhood, Coinbase, and Yahoo Finance.

- State Identification: The bot evaluates market conditions, price trends, and historical data to determine its current state.

- Action Selection & Reward Calculation:

- If a trade results in profit, the bot assigns a high reward to the decision.

- If a trade leads to a loss, the bot adjusts by reducing the reward associated with that action.

- Continuous Learning & Strategy Refinement: Over time, ARC Trader remembers which actions generated the highest rewards and automatically adapts to improve future trades.

- Exploitation vs. Exploration: The bot balances between:

- Exploiting known profitable strategies.

- Exploring new approaches that might yield better results.

By constantly repeating this process, ARC Trader evolves into a smarter and more efficient trader, ensuring that users benefit from continuously optimized trading decisions.

How ARC Trader Leverages Market Data for Smarter Trading

Unlike static trading bots that rely on fixed rules, ARC Trader continuously adapts by integrating vast amounts of financial data. This data-driven approach allows it to:

- Detect market trends faster than human traders.

- Predict price movements based on historical patterns.

- Optimize trade execution by selecting the most profitable entry and exit points.

Real-Time Data Processing for Maximum Profitability

To stay ahead of market volatility, ARC Trader seamlessly integrates with multiple data sources:

- Robinhood API – Real-time stock and crypto price feeds.

- Coinbase & Crypto Exchanges – Live cryptocurrency market trends.

- Yahoo Finance – Broader financial and economic indicators.

This multi-source approach ensures high data accuracy and a well-rounded market perspective, allowing the bot to refine its Q-learning model for improved decision-making.

Why ARC Trader’s Continuous Learning Model Gives Users an Edge

1. Adaptive Strategy Refinement

ARC Trader never stops learning—it continuously evaluates new trades, adjusting its approach to stay profitable even in unpredictable market conditions.

2. Elimination of Emotional Trading

By removing human emotions from the equation, ARC Trader ensures data-driven, logical trading decisions that maximize profitability.

3. Hands-Free Profits with Automated Execution

Once a profitable strategy is identified, ARC Trader automatically executes trades through the Robinhood API, eliminating the need for manual intervention.

4. Faster Response to Market Changes

Traditional traders react to the market after price shifts occur. ARC Trader anticipates price movements by leveraging Q-learning insights, allowing it to execute trades ahead of market trends.

5. Customizable Trading Strategies

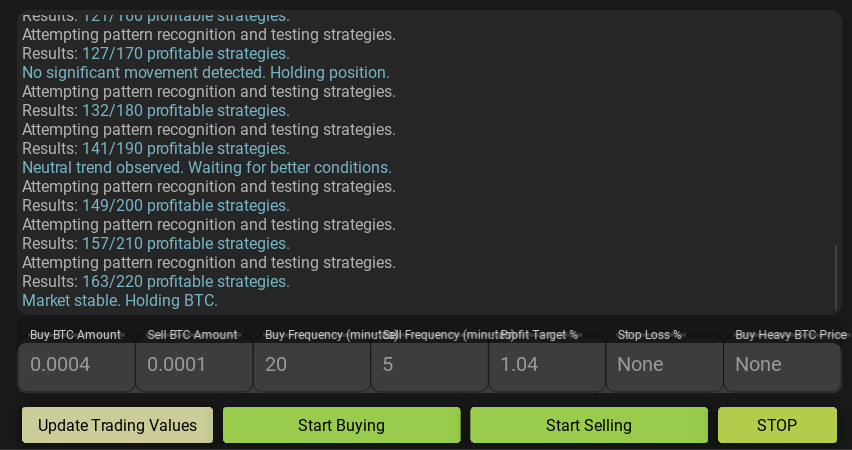

Users can fine-tune ARC Trader’s parameters, setting:

- Cryptocurrency amounts,

- Frequency, how often to check the market for favorable conditions.

- Profit Margins and Sell signals.

This customization ensures that ARC Trader aligns with individual trading goals while continuously enhancing its profit-maximizing strategies.

The Future of AI-Driven Trading: Smarter, Faster, More Profitable

As financial markets grow more complex, ARC Trader represents the next generation of AI-powered trading, blending Q-learning, data-driven decision-making, and real-time execution into a fully automated, self-improving trading bot.

By continuously training itself on market data, ARC Trader ensures that users always trade with the most effective strategies, adapting to market fluctuations without manual intervention.

💡 Want to trade smarter? Let ARC Trader’s AI-driven learning system do the work—so you can focus on maximizing your gains. Try it today!